Asymmetry in Earnings Management Surrounding Targeted Ratings

Seminar Date

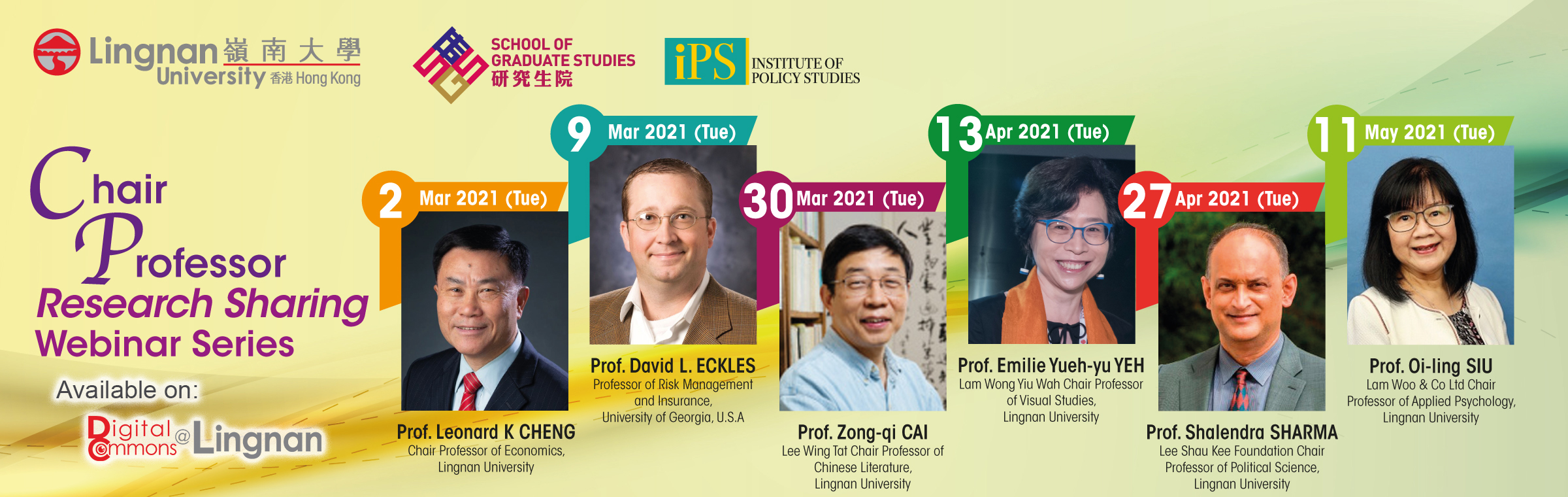

3-9-2021

Abstract

This study investigates asymmetric incentives in firms managing earnings in an attempt to achieve a target financial strength rating. We find empirical evidence that firms with an actual rating below their target rating use income-increasing earnings management. However, we find no evidence that firms above their target rating manage earnings. Our findings are robust to a variety of alternative definitions of target rating. Notably, we examine a subset of firms with an exogenously determined target rating and find consistent results. These findings indicate that firms have incentives to reach a target rating if they are rated below their target, but not above their target.

Highlight:

https://www.ln.edu.hk/sgs/chair-professor-research-sharing-webinar-02-highlights

Language

English

Recommended Citation

Eckles, D. L. (2021, March 9). Asymmetry in earnings management surrounding targeted ratings [Video podcast]. Retrieved from https://commons.ln.edu.hk/chair-professor-webinar/2/

Biography of Speaker

Professor David L. Eckles currently teaches in the undergraduate, MBA, and Ph.D. programmes at the University of Georgia. He is also the coordinator for the risk management and insurance internship programme as well as the Graduate Coordinator for the risk management and insurance Ph.D. programme. Prior to joining the faculty in 2005, Professor Eckles was on faculty in the Department of Finance and Quantitative Analysis at Georgia Southern University. He was three times awarded the Les B. Strickler Innovation in Instruction Award by the American Risk and Insurance Association (ARIA) and has been the recipient of ARIA’s small conference grant.

Professor Eckles received an undergraduate degree in risk management and insurance and finance from the University of Georgia. He received an M.A. and Ph.D. from the Wharton School of the University of Pennsylvania where he was an S.S. Huebner Fellow. While at the University of Pennsylvania, he was also a Sloan Fellow at the Wharton Financial Institution Centre.